One intriguing aspect worth delving into is the relationship between the frequency of maintenance and the overall condition of the property.

An exploratory data analysis was carried out to unravel the correlation between these two variables and the subsequent financial implications for businesses in the real estate sector.

Exploratory Data Analysis:

1. Data Quality:

- Our dataset harbored a significant gap, with the maintenance frequency missing around 63% of its values.

Despite this setback, a coherent pattern emerged, illuminating the impact of maintenance on property condition.

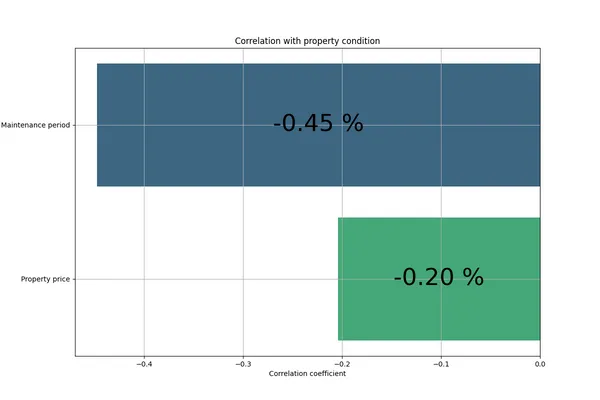

2. Correlation Analysis:

- The analysis revealed a correlation coefficient of about -0.45 between property condition and maintenance period (frequency).

Although this figure falls slightly short of the -0.5 mark, it remains significant, showcasing a discernible trend amidst the considerable data void.

3. Statistical Confirmation:

- The statistical analysis echoed the correlation, underscoring a tangible trend that properties in prime condition necessitate less frequent maintenance compared to their dilapidated counterparts.

.webp)

Business Implications:

1. Cost Efficiency:

- Businesses managing real estate properties could glean substantial Opex savings by renovating buildingpart at the right rime. Futher to invest in preventive maintenance that keeps builingpart in condition 2 & 3, which shows to be where the business case sits.

thus reducing the frequency of Opex and potential Capex of future maintenance.

2. Property Value Preservation:

- A well-maintained property not only basks in an extended lifespan but also retains its market value.

This is a boon for businesses looking to maximize their ROI in the long term.

3. Tenant Satisfaction and Retention:

- Properties in good condition are likely to foster higher tenant satisfaction, which in turn, translates to lower tenant turnover.

This is a significant advantage given the cost of acquiring new tenants.

4. Regulatory Compliance and Risk Mitigation:

- Adhering to a robust maintenance schedule minimizes the risk of regulatory non-compliance and potential legal entanglements,

which could be financially draining and tarnish the business's reputation.

5. Strategic Planning:

- Armed with the insight from the data analysis, real estate businesses can fine-tune their maintenance strategies,

allocate resources more judiciously, and make informed decisions that bolster their bottom line.

Conclusion:

The analysis unveils a compelling narrative on the intertwined fate of maintenance frequency and property condition.

As the adage goes, “Prevention is better than cure,” and in the real estate sector, a proactive maintenance regimen can indeed be a financial panacea.